Mastering Personal Debt Management in 2024

Introduction

Managing personal debt can be a daunting task, but with the right strategies, it becomes manageable and empowering. In 2024, individuals are seeking efficient methods to control their financial obligations and ensure future stability. By understanding the fundamentals of debt management, anyone can ease their financial burden and work toward prosperity.

Advertisement

Understanding Your Debt

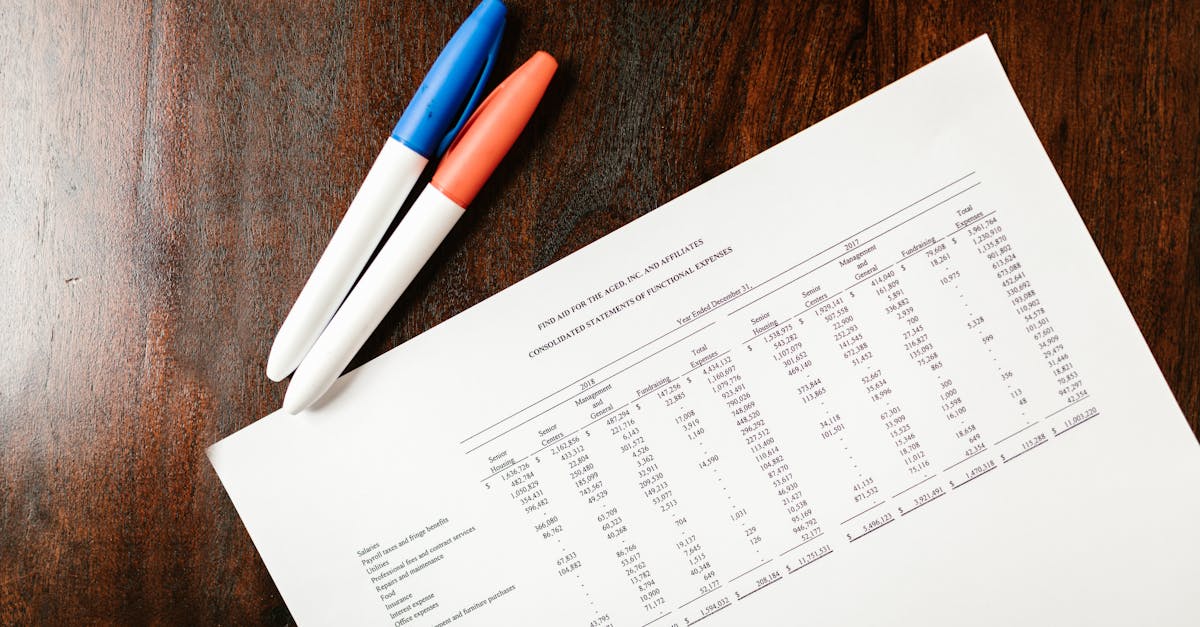

The first step in managing personal debt is to thoroughly understand what you owe. Collect all your financial statements, including credit card bills, loan statements, and any other outstanding balances. Calculate the total sum you owe, acknowledging both principal amounts and any accumulated interest. Knowing this information is essential for establishing a realistic repayment plan.

Advertisement

Creating a Budget

A personalized budget is crucial for keeping your finances in check. Start by listing your monthly income and expenses, and identify areas where you can reduce spending. Allocate a specific portion of your income toward debt repayment each month. A well-defined budget helps you track your spending, avoiding unnecessary expenditures, and ensures you are consistently paying down your debt.

Advertisement

Prioritizing Debts

With multiple debts, it may be overwhelming to decide which to tackle first. Consider adopting either the 'debt snowball' method, focusing on paying off the smallest debt first, or the 'debt avalanche' approach, targeting the highest interest debt first. Each method has its benefits, so choose the one that suits you best for maintaining motivation and reducing financial strain.

Advertisement

Exploring Debt Consolidation

Debt consolidation might be a viable option for some, offering an organized way to manage multiple debts by combining them into a single loan or credit line. This can simplify payments and potentially lower interest rates. However, it's essential to evaluate the terms and ensure consolidation will genuinely save you money over time.

Advertisement

Negotiating with Creditors

Do not hesitate to reach out to your creditors and negotiate better terms. Creditors may be willing to lower interest rates, waive fees, or even settle for a reduced payment if you demonstrate genuine financial hardship. Being proactive and transparent about your situation can lead to significant reductions in your overall debt burden.

Advertisement

Increasing Income

Boosting your income is another strategy to tackle debt more effectively. Consider pursuing additional work, freelance opportunities, or a side gig to generate extra funds. Applying this additional income directly to your debt payments can accelerate your path to financial freedom, especially when combined with careful budgeting and expenditure control.

Advertisement

Avoiding New Debt

As you work toward eliminating existing debt, it's crucial to avoid accumulating new obligations. Resist the temptation of taking out additional loans or using credit cards unless absolutely necessary. Practicing restraint and maintaining a disciplined approach to your spending will prevent new debt from derailing your progress.

Advertisement

Regularly Reviewing Financial Goals

Regularly assess your financial goals and progress to ensure you stay on track. Set milestones for repayment and celebrate each accomplishment, no matter how small. This positive reinforcement can sustain motivation, allowing you to see tangible progress and adjust your strategies if needed, ensuring long-term financial health.

Advertisement

Conclusion

In conclusion, effectively managing personal debt in 2024 requires a combination of planning, resourcefulness, and discipline. By understanding your debt, creating a budget, and exploring options like consolidation or negotiation, you can ease the financial burden and work toward a stable financial future. Remember, achieving debt freedom is a journey that demands perseverance and commitment.

Advertisement